Safeguarding Audits

For Payment Institutions and Emoney Firms in the UK and Europe.

Low Cost Bank Safeguarding Audits for Regulated Firms.

Pragmatic assistance to improve your score before final audit report issued.

Safeguarding Audits for Authorised Payment and Emoney Firms

AuthoriPay are specialists in safeguarding solutions for UK and European payment firms.

We provide commercial advice to help firms reduce the cost of their safeguarding arrangements. Many businesses currently pay £8,000–£13,000 per month for single-currency safeguarding, often unnecessarily.

We offer low-cost, fast-turnaround safeguarding audits for FCA-authorised firms.

We also provide safeguarding audits for European firms, as safeguarding obligations remain closely aligned across the UK and EU even after Brexit.

We stay fully up to date with all the latest regulatory developments across both jurisdictions, including the FCA’s 2026 safeguarding reforms and the EBA’s safeguarding guidance.

Firms are given the opportunity to remediate any findings before the final audit is issued, ensuring a clean and defensible audit outcome.

Discount safeguarding audits are available for SPIs, SEMIs and startups.

What does a safeguarding audit look at?

AuthoriPay helps institutions meet their safeguarding obligations by delivering a comprehensive audit that evaluates all key components of the safeguarding framework. Our audits are aligned to the strengthened FCA 2026 safeguarding rules as well as EU/EBA safeguarding guidelines, ensuring compliance across both jurisdictions.

Our safeguarding audit assesses:

Governance and oversight

Board and senior management responsibilities, safeguarding oversight, and adequacy of internal governance arrangements.Implementation of safeguarding methods

How customer funds are segregated, safeguarded, and protected under the applicable regulatory regime (UK PSRs/EMRs or EU PSD2/EMD2).Systems and controls

Testing the design and operational effectiveness of controls, including exception handling, outsourcing arrangements, and documentation standards.Reconciliation processes

Review of daily reconciliations, data integrity, break management, evidential standards, and alignment with the FCA’s enhanced 2026 requirements or the EBA’s safeguarding guidelines.Safeguarding account arrangements

Verification of custodians, trust status (UK), account acknowledgements, safeguarding confirmations, and appropriateness of safeguarding institutions.Preparedness for insolvency and wind-down

Assessment of wind-down planning, operational continuity, insolvency outcome documentation, and customer fund protection measures.Audit readiness and statutory auditor involvement

Where required under the 2026 UK regime, we assist firms in preparing for the mandatory annual safeguarding audit and can help source or liaise with an appropriate statutory auditor.Remediation opportunities before final audit

Firms are given the chance to address any issues identified in the gap analysis prior to issuance of the final safeguarding audit report.

Recommendations for Alternative Banking & Safeguarding Providers

As part of our safeguarding audit process, we will make tailored recommendations for alternative banking and safeguarding providers, including options that offer:

Additional currencies

Lower fees or more cost-effective safeguarding structures

Access to alternative payment networks, such as SEPA or FEDWIRE

Higher risk appetite, including support for crypto, gaming, and other specialist sectors

Contingency arrangements, including backup accounts in the event of account closure — particularly important for remittance firms operating in higher-risk regions or corridors

We can also facilitate introductions and oversee the onboarding process

“The new safeguarding rules require most payment and e-money firms to arrange annual audits of their safeguarding compliance…”

— FCA Policy Statement PS25/12 (August 2025)

Does a Safeguarding audit involve a visit?

Most firms now prefer remote safeguarding audits, and this remains the standard approach. However, we can also conduct an onsite review if required. The onsite option simply extends the duration of the process.

We offer two delivery options:

Remote Audit

Remote Audit followed by Onsite Review

Our approach is as follows:

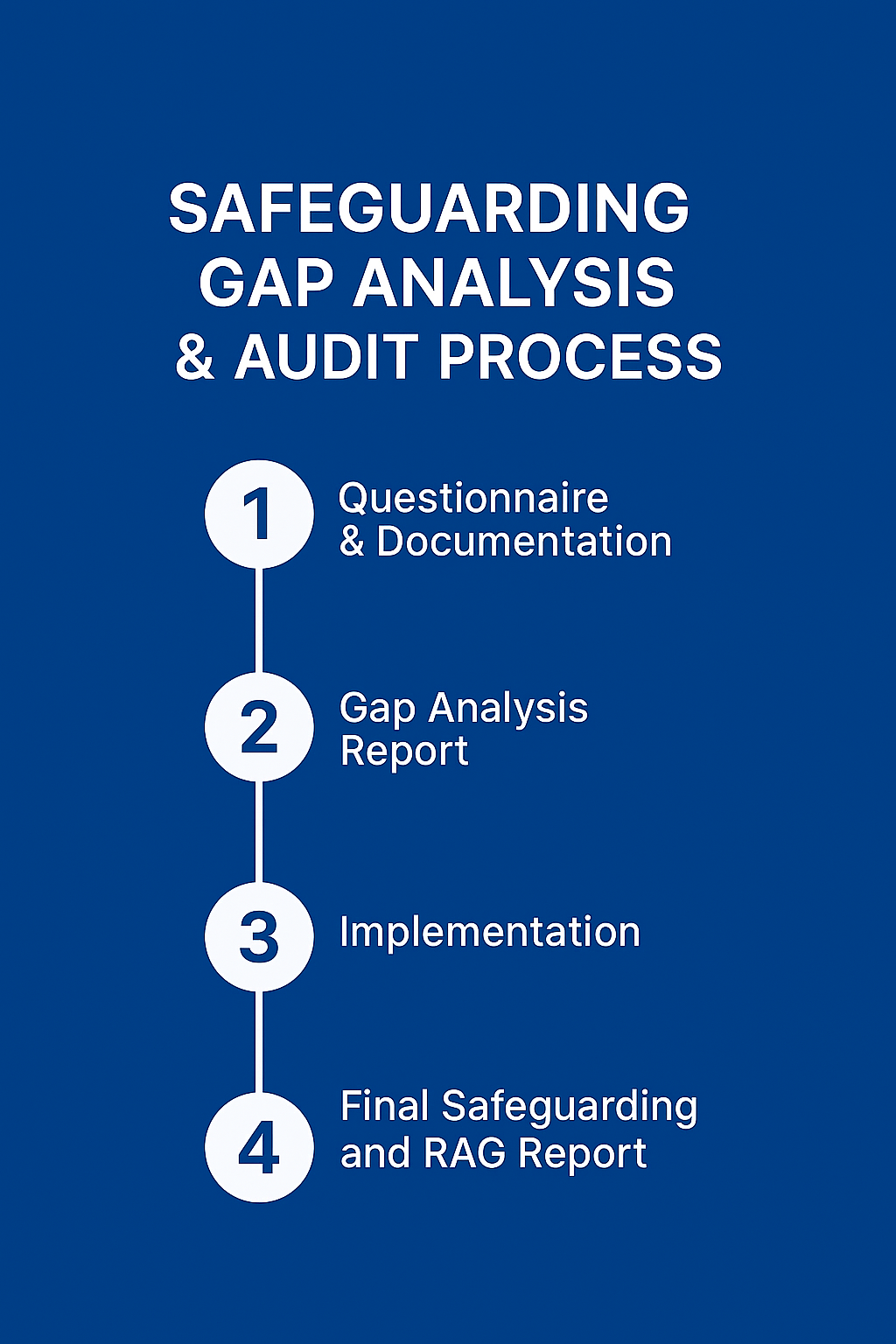

1. Questionnaire & Documentation Review

We begin by sending a questionnaire and requesting supporting documentation. This allows us to assess your safeguarding controls, reconciliation processes, governance, and account arrangements.

2. Gap Analysis

We conduct a detailed desktop review and produce a gap analysis report highlighting areas of compliance, weaknesses, and recommended actions.

If an onsite visit is required, this takes place during this stage to observe processes and controls first-hand.

3. Remediation Period

Before the final audit is issued, firms are given the opportunity to address any findings. We assist with remediation where needed to ensure the final report reflects the strongest version of your safeguarding environment.

4. Final Safeguarding Audit Report

Once remediation is complete, we issue a final safeguarding audit report. This includes a RAG rating, full findings, and evidence that your safeguarding arrangements meet UK or EU requirements.

Approximate timescales from start to finish are:

Questionnaire & Documentation Received

(Firm-led – usually takes 1–2 weeks to complete)Gap Analysis Report

(5–7 days)Implementation / Remediation

(Firm-led – usually takes 3–4 weeks to complete)Final Safeguarding Audit & RAG Report

(5–7 days)

If an onsite review is required, the overall timeline will be longer.

Why Choose AuthoriPay?

We are an established, highly regarded consultancy with deep expertise in safeguarding for payment and e-money firms in both the UK and EU.

Our team has significant specialist experience in assessing compliance with the safeguarding requirements under the PSRs/EMRs, PSD2/EMD2, and relevant FCA/EBA guidelines.

- Our audits are conducted in accordance with ISAE 3000 (assurance engagements other than audits or reviews of historical financial information).

We provide formal Type 2 assurance opinions on a firm’s compliance with safeguarding requirements, including the design and operating effectiveness of controls at the point of audit.

Throughout every engagement we take into account the size, complexity and business model of the firm, and our objectives are to:

- Assess the quality and robustness of existing safeguarding controls

- Identify any gaps or weaknesses

- Provide clear, practical and commercially realistic recommendations to address them

AuthoriPay offers one of the lowest-cost safeguarding audit options available to regulated firms, while maintaining exceptional technical quality and fast turnaround times.

Get in touch

AuthoriPay Ltd, Milton Hall, Ely Road, Cambridge, CB24 6WZ.