AML Gap Analysis & Audit

Low-cost, High Quality and collobarative

AML Audit Requirements

Any business supervised for anti-money laundering — whether in the UK, EU or any other jurisdiction — is expected to undergo a regular independent AML audit, typically on an annual basis. Annual AML audits form a core expectation of:

-

Regulatory and supervisory bodies

-

Banking partners

-

Payment and EMI partners

-

Investors, counterparties and due-diligence teams

Across all jurisdictions, supervisors and financial partners increasingly require evidence of a recent, independent AML audit as part of onboarding and ongoing monitoring.

A yearly AML audit demonstrates:

-

The effectiveness and maturity of your financial crime framework

-

That senior management are exercising appropriate oversight

-

That your policies and procedures remain current and proportionate

-

That your business meets recognised global AML standards

Regular audits also ensure early identification of weaknesses, alignment with industry best practice, and smoother regulatory engagement across multiple jurisdictions.

AuthoriPay takes a pragmatic, proportionate approach to AML audits — focusing on what is genuinely important, tailored to your business model, rather than applying a generic or overly rigid template.

Who are our audits for?

Our audits are suitable for all financial services firms including:

- Payment Service and Electronic Money Firms authorised by the FCA

- Professional Services Firms based in the UK or EEA

- Money Service Businesses regulated by HMRC for AML purposes

- Annex 1 firms registered with the FCA

- Crypto firms registered with the FCA

- EEA based Payment and Emoney Institutions

- Canadian MSBs

- MENA-based payment and emoney firms

- Small UK and EEA banks

- All types of MiFID investment firm

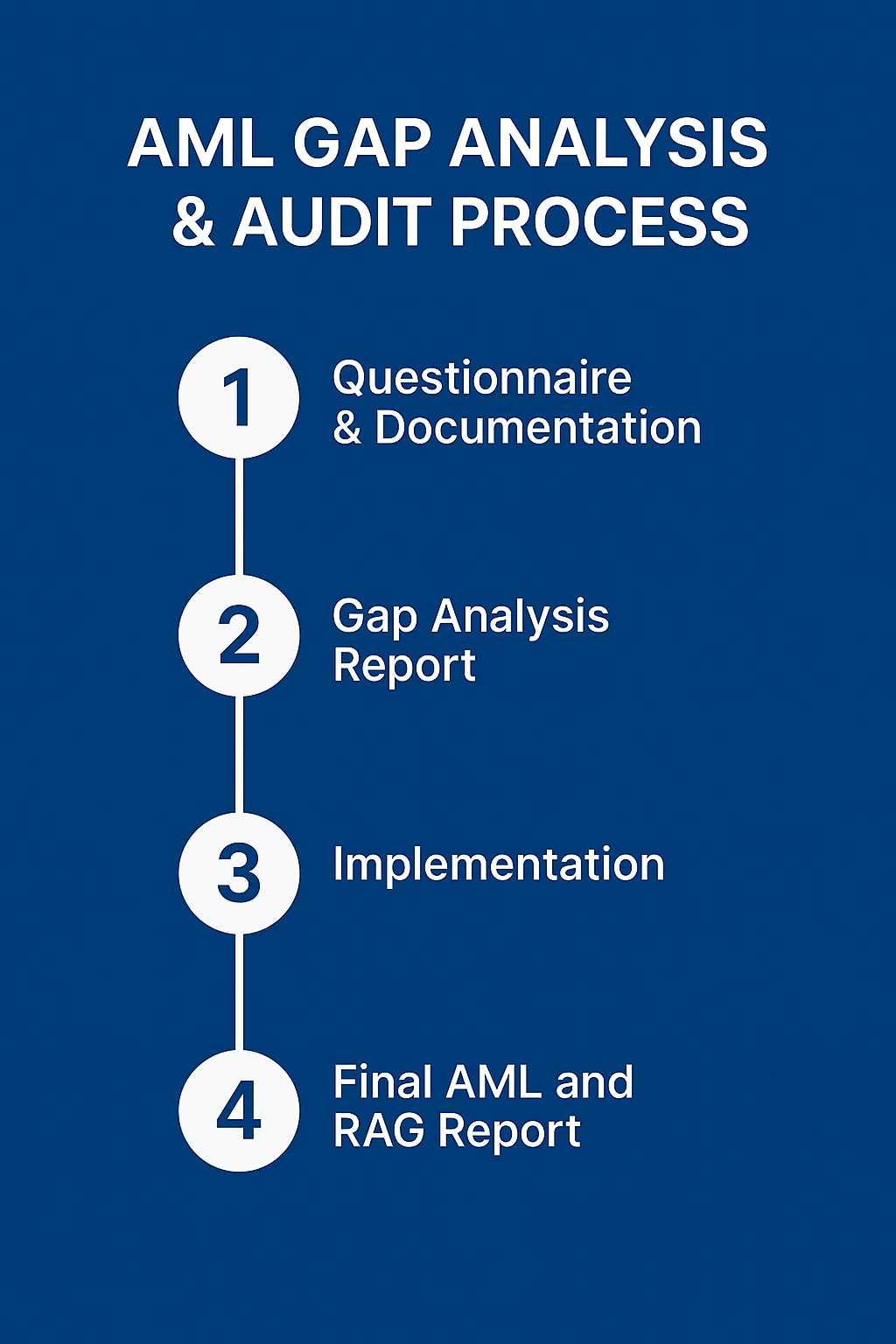

Our AML audits can be delivered remotely or onsite and follow a clear four-stage process:

Stage One: Initial Questionnaire & Documentation Review

AuthoriPay sends the auditee our AML Audit Questionnaire, designed to assess all key elements of AML/CTF regulation and compliance. The auditee completes the questionnaire and returns it together with all relevant AML documentation (policies, procedures, risk assessments, governance materials, etc.). Where possible, we also request a brief walk-through of the firm’s CDD processes to understand how controls operate in practice.

Stage Two: Gap Analysis Report

We review the completed questionnaire, supporting documents and any CDD walk-through notes. AuthoriPay then issues a Gap Analysis Report identifying any areas for improvement, with clear recommendations the auditee can implement to strengthen its AML framework ahead of the formal audit.

Stage Three: Implementation of Recommendations

The auditee updates its AML framework based on the findings of the Gap Analysis.

If needed, AuthoriPay can provide additional support to help implement the recommended enhancements in a practical and proportionate manner.

Stage Four: Final AML Audit & RAG-Rated Report

Once updates are complete, the auditee resubmits the revised documentation.

AuthoriPay conducts the final AML audit and issues a comprehensive report containing:

-

Detailed findings

-

Evidence references

-

Red / Amber / Green (RAG) ratings across each domain

-

An overall AML compliance rating

-

A stamped one-page summary suitable for sharing with banks or partners

Scope

While it’s referred to as an AML AUDIT, we cover not just AML, but also Counter-Terrorist Financing and Financial Sanctions. We focus on all aspects of compliance including:

- Customer Due Diligence (CDD, KYC, Ongoing monitoring)

- Risk Assessments

- Suspicious Activity Reporting

- PEPs, Sanctions screening

- Enhanced Due Diligence

- Internal controls and governance

- Any other areas requested by your bank or the regulator such as Senior Manager Interviews.

Timescales

The timeframe for completing an AML audit depends primarily on how long a firm takes to prepare and update its documentation. In most cases, the process follows the outline below:

Completion of the Questionnaire

Most firms take 1–2 weeks to complete the AML Audit Questionnaire and gather the required documentation for the initial review.

Gap Analysis Report

Once we receive your materials, AuthoriPay prepares the Gap Analysis Report within 5–7 working days.

This sets out all areas for improvement along with a clear action plan.

Implementation Period

You can take as long as you need to implement the recommended updates.

On average, firms take 2–3 weeks, depending on the maturity of their AML framework.

Final Audit Report

After you update your documentation, you resubmit the questionnaire and supporting evidence.

AuthoriPay then begins the full audit and issues the final RAG-rated (Red, Amber, Green) report within 5–7 working days.

Fees

Our Fees are 30% below the market rate yet our auditors are experienced, fair-minded and well regarded. We pride ourselives on providing only the highest levels of service to all our clients, whether you’re a boot-strapped startup or an establshed bank.

Other Services

AuthoriPay also offers ancillary audit services listed in the buttons below:

Get in touch

AuthoriPay Ltd, Milton Hall, Ely Road, Cambridge, CB24 6WZ.